MP McCrimmon’s free tax clinic is here again

WEST CARLETON – An annual tradition for those who need tax help, Kanata-Carleton MP Karen McCrimmon’s free tax clinic is back, this time online.

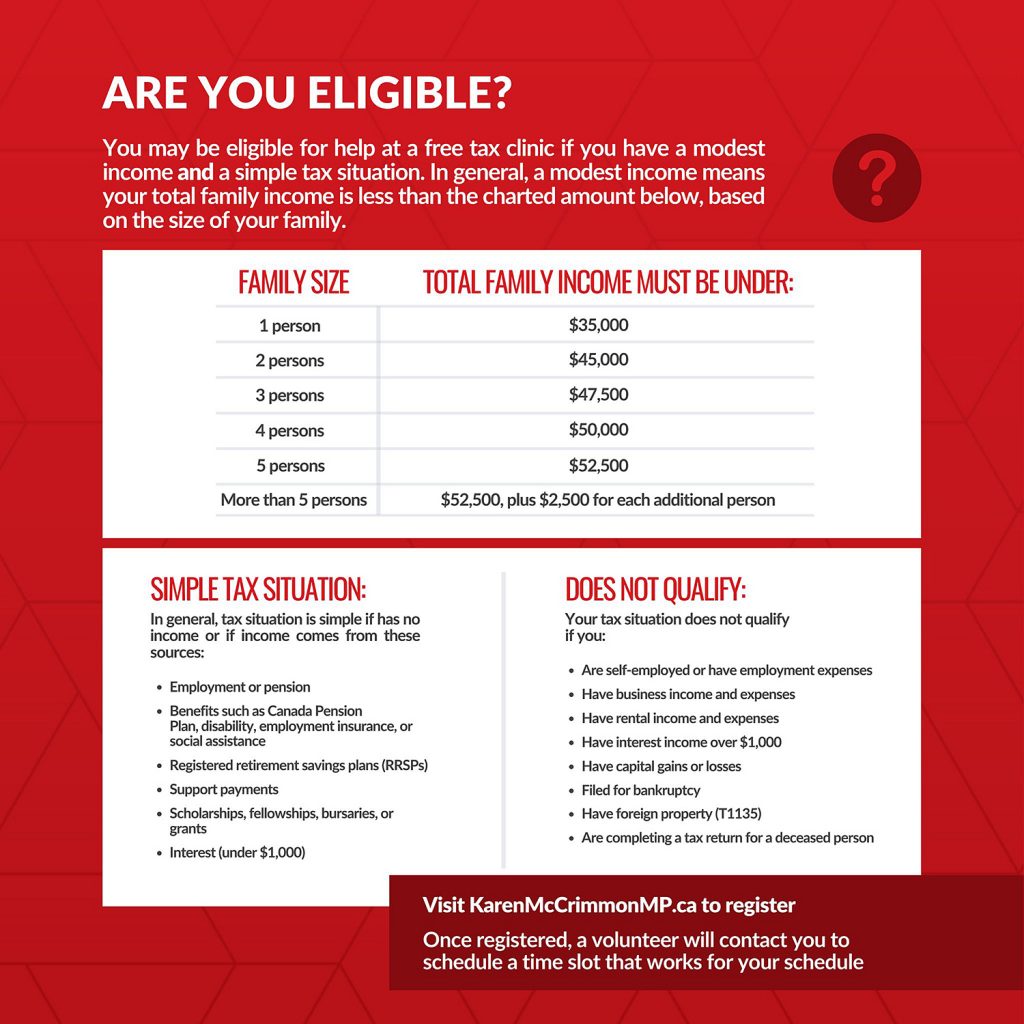

“You may be eligible for help at a free tea clinic if you have a modest income and a simple tax situation,” McCrimmon’s staff released in a statement Thursday, March 4.

In general, the MP defines a modest income as an individual whose family income is less than $35,000 to a five-person family with an income of less than $52,500 (see graph for more categories).

Calling Kanata-Carleton residents,” McCrimmon said. “Need help with your 2020 tax return? See if you are eligible for help at my annual free virtual tax clinic. This year we’ll be helping by phone, by appointment only, to keep everyone safe during the COVID-19 pandemic.”

A tax situation is defined as simple if the recipient has no income of if their income comes from employment or pension; benefits such as the Canada Pension Plan, disability, employment insurance or social assistance; a registered retirement savings plan; support payments; scholarships, fellowships, bursaries or grants; interest under $1,000.

To register for help, visit karenmcrionmp.ca. Once registered, a volunteer will contact you to schedule a time slot that works for your schedule.